Trends in transactional banking and the race to digital

As business models shift because of COVID-19, there is a strong sense that innovations which have become mainstream because of the pandemic will reshape consumer and organisational behaviour for many years to come.

Payments NZ’s recently released 2021 Environmental Scan Report notes that globally there has been a clear change in consumer behaviour over the past 18 months due to living in different stages of lockdowns and this rapid shift is unlikely to reverse now that it is becoming second nature. As businesses adjust to this new world there has been a requirement to quickly scale up digital innovation and to use e-commerce for maintaining existing and growing new business. McKinsey & Company, global management consultants, concluded that ten years of digital innovation occurred in approximately three months in 2020 and, that internationally, e-commerce increased by two to five times pre-pandemic levels.

Innovation acceleration in the payment space

The pandemic has caused a sharp pivot from physical to digital in nearly every aspect of society. Working from home or remotely has become commonplace, home delivery and click-and-collect has replaced in-store shopping, and online exercising and wellness have become the new norm.

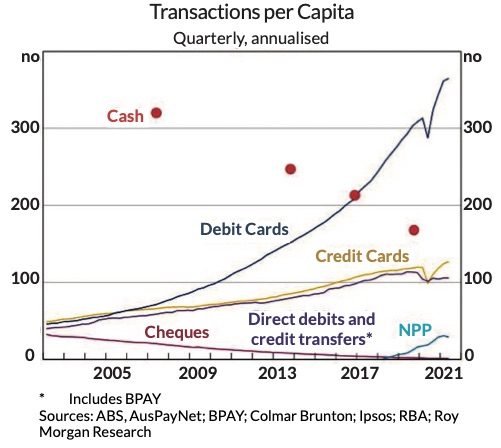

Unsurprisingly then, the way we make and receive payments is now evolving rapidly as a result. We have seen an acceleration of non-cash transaction methods, a greater reliance on new digital solutions to improve the customer experience, and a need to integrate payments into those digital solutions. Payments will need to be made anytime, from anywhere and across borders to support a more diverse and rapidly evolving set of use cases.

In New Zealand, COVID-19 increased the adoption of contactless payments, accounting for 39% of total card use in 2020, a 62% increase since 2018. It also saw the use of contactless enabled terminals increase from 36% in January 2020, to 52% in December 2020 indicating the upward momentum of contactless transactions will continue. Additionally, the pandemic saw the first widespread mainstream deployment of QR codes as part the NZ COVID Tracer app, and the soon to be released vaccination passport. This deployment has the potential to pave the way for other uses of QR codes in New Zealand, including in retail payment settings which has become common practice in many Asian and African countries.

New Zealand and Australia, while not at the forefront of these digital transformations, are close followers in terms of their respective rollouts of new technology and payment infrastructure. Digital and mobile wallets are becoming more mainstream, and the uptake has been particularly strong in younger generations. There is also a clear shift from credit to debit over recent years as well as the rise in ‘buy now pay later’ alternatives to credit.

Open banking is happening now

The time is ripe for innovation in the local financial service sector considering the moves by respective Governments to progress with ‘open banking’ initiatives. The New Zealand Government recently announced proposed legislation for a Consumer Data Right. In short it will give consumers the right to own, manage and request the transfer of their data between interested parties. While this all sounds fairly boring and irrelevant, this announcement is part of a much bigger and fundamental change to the services we receive, and the prices paid for these services.

Open banking, while slow to get going due to many reasons — regulators slow to introduce change, banks slow to develop the APIs (software integration services) required for innovation, and international disruptors prioritising other countries over expansion into New Zealand — is on the cusp of providing consumers greater choice of digital services and at lower prices. Many of the ways of banking we have all become used to such as using bank account numbers and accepting ‘high’ merchant fees could soon be a thing of the past.

BlinkPay is a local fintech that is wanting to be one of the first to make use of the opportunities that open banking can provide. It’s initial products to market are ‘Blink PayNow’ and ‘Blink AutoPay’ which enable one-off and recurring payments to be made via BNZ’s secure, Payment NZ specified APIs. The payment products appear to offer easy, fast, secure and low-cost alternatives for businesses and consumers, and we will be watching its progress closely.

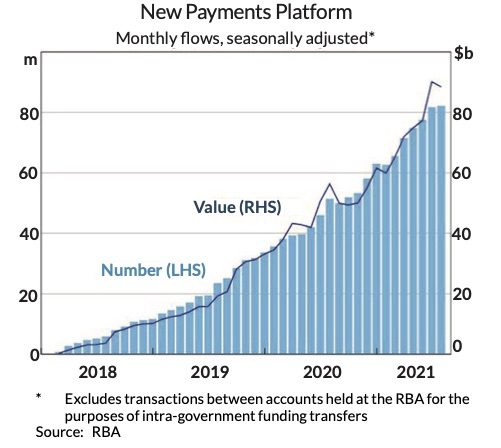

In Australia, the New Payments Platform has enabled real-time transactions between accounts but to date has largely been used for peer-to-peer transfers and as an alternative for card transactions at small businesses during the pandemic. However, wider use cases are coming, with the new ‘PayTo’ overlay which will allow for authorised pull payments from bank accounts with various user cases including replacing the functionality of direct debits with a far more user-friendly alternative.

The race to digital is well underway

We understand that while some businesses want to be at the forefront of new technology and are happy to be involved in pilot projects, many businesses do not want to be the testers of new products – particularly in the payments space. From a consumer perspective, digital and mobile wallets are becoming more mainstream and the uptake has been particularly strong in younger generations. There is also a clear shift from credit to debit over recent years as well as the rise in ‘buy now pay later’ alternatives to credit.

As highly experienced and independent advisors in transactional banking we can guide businesses through the opportunities and pitfalls that we have seen others work through, as well as providing a rigorous examination of costs and benefits of these new opportunities.

A channel review by Bancorp analysts can explore how payment/receipting channels might be better aligned to consumer demand and help support governance, by addressing the key questions of:

How do you receive payment?

How do you make payments?

How do you manage money (account structure, sweeping and pooling, fees, etc)?

How do you fare against your peers?

For advice or assistance, or to undertake a quick transactional banking review, talk to the Bancorp’s experienced treasury team. Call Dean Sharrar on +64 9 912 7590.