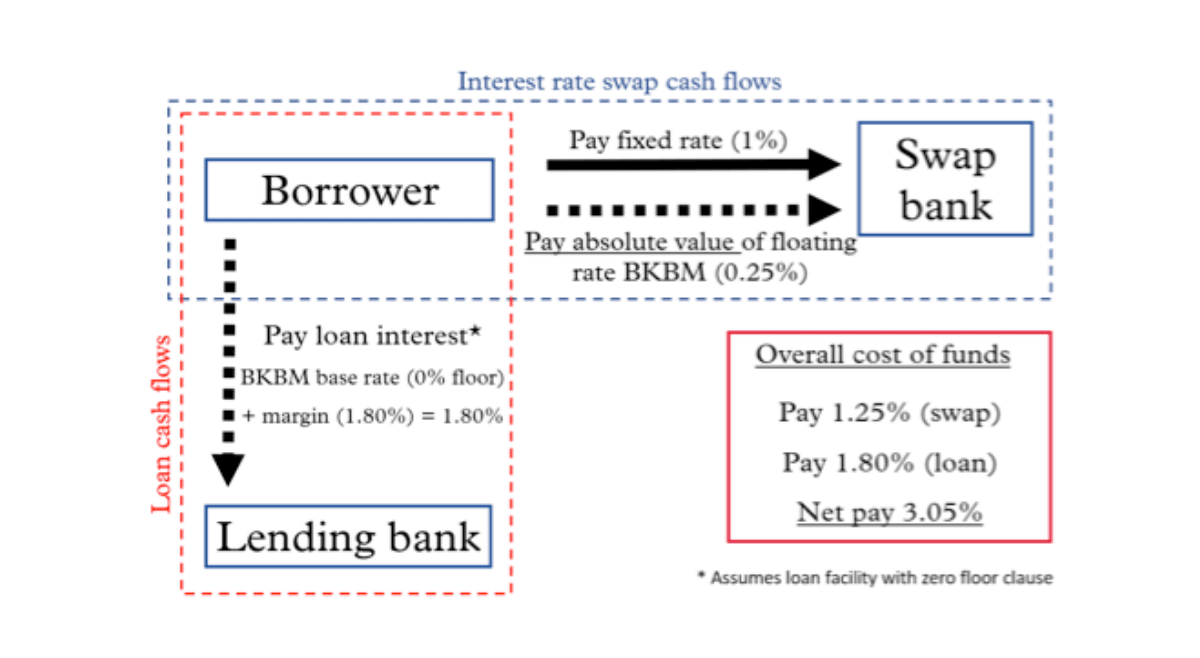

Our last blog in the new ‘normal’ series, focused on negative interest rates – this time we take a look at the issues that could be presented by a negative Bank Bill Benchmark Rate (BKBM).

Firstly, it is important to distinguish between the different interest rates. The OCR is set by the Reserve Bank (currently 0.25%). This is the interest rate that commercial banks receive for holding surplus cash in their settlement accounts with the RBNZ. This strongly influences the supply and demand for Bank Bills, captured by the BKBM interest rate benchmark. The BKBM benchmark underpins most corporate loan documentation and interest rate hedging structures and is therefore most important to corporates.

“It had been 15 years since we last went out to market. No-one in the business had direct knowledge or history of running a transactional banking RFP, so we went back to Bancorp. Bancorp had a clear understanding of the banking industry, counter parties and a good knowledge of what the market was doing. The report helped us to identify our target savings and gave us confidence that going to market was a worthwhile exercise.”

“It had been 15 years since we last went out to market. No-one in the business had direct knowledge or history of running a transactional banking RFP, so we went back to Bancorp. Bancorp had a clear understanding of the banking industry, counter parties and a good knowledge of what the market was doing. The report helped us to identify our target savings and gave us confidence that going to market was a worthwhile exercise.”